After reading these FAQ's, contact us to set up a phone interview, to see if a short sale is best for you.

What is a Short Sale?

In the world of Real Estate, a short sale refers to the sale of real property for an amount less than the amount owed on the property. In the short sale scenario, the bank agrees to accept less than the full balance due on the debt, and usually ‘forgives’ all or a large portion of the difference.

How will the Short Sale affect my credit?

Short Sales are still a relatively new concept. Banks have the option of submitting the short sale to the credit bureau as "Paid in Full" or "Settled for less than full balance". As far as your credit score is concerned, there is no evidence whatsoever to support that a short sale will lower your credit score. Some have the idea that this is like a bankruptcy or a foreclosure. That's far from the truth! In a short sale, the lender is simply allowing you to pay less than you owe!

If you are currently behind on your mortgage or facing foreclosure, the short sale will actually help your credit! How? Because once you are approved for the short sale, all collection activity will STOP and you will avoid foreclosure! Foreclosure is what you want to avoid, this will seriously impact your credit and clearances you have.

If your credit score is lowered slightly because of the short sale, just like any negative impact on your report, you start rebuilding it once that negative impact happens. You have to ask yourself. Is a 100 point decline in my credit score worth it to me. If I can recover from this hit in 1-2 years (most of the time sooner) and be forgiven over $75,000 in debt and start over financially, is that worth it to you ?

Do Lenders Approve all Short Sales?

In a word, No. That is why it is critical to work with someone that has extensive training and experience at getting Short Sales approved.

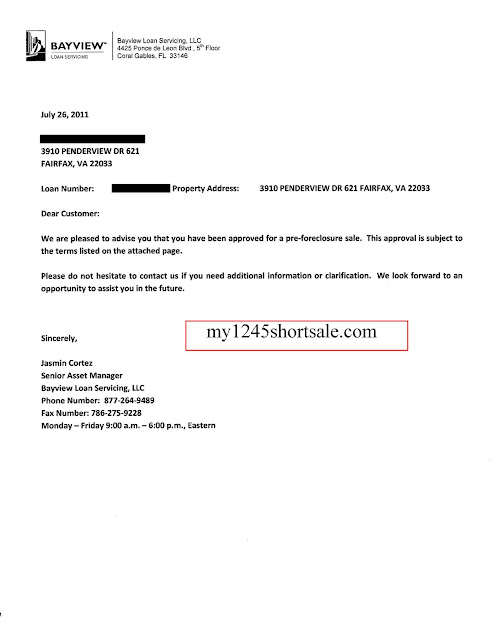

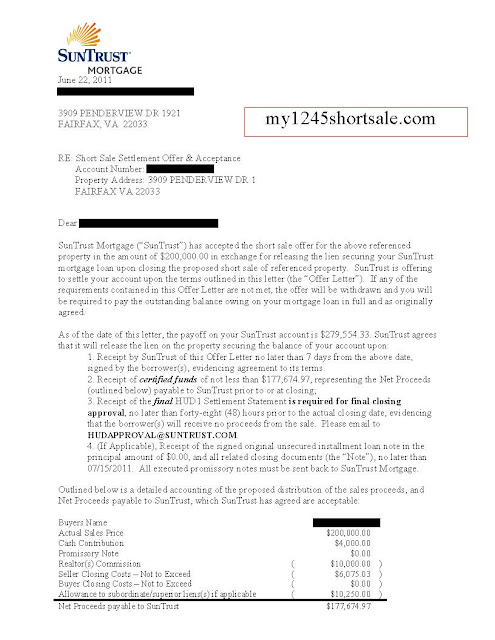

The national average for completing short sales is well below 40% . Right now we are 15 for 15 since last year and we have 3 more closing in April.

From the presenation of the Short Sale package to the lender to working with the lenders Loss Mitigation Department and investors of the loan and even Mortgage Insurance companies, we know how to keep the file moving towards approval. Not to mention we know how to negotiate with the banks to get the best outcome possible.

The first step is to get pre-qualified for a Short Sale. There is no charge for this, and its easy.

Email us and we will set up a time to talk with you.

Who benefits from the Short Sale?

Short sales are a win-win situation. Lenders, Mortgagees and Realtors all benefit from the successful short sale. Mortgagors get the majority of their money back, Mortgagees get the relief they need and are able to sell their property and avoid foreclosure, and Realtors can facilitate the transaction and receive compensation (commission) from the sale of the property.

Why would banks forgive the difference?

To mitigate their losses, banks often accept a settlement of less than what is owed on the property. When faced with the option of getting the property ‘back’ through foreclosure, a short sale often makes a much wiser business decision for the bank.

This sounds too good to be true!?

Not really. Things that are ‘too good to be true’ usually don’t make good economic sense. The short sale makes good common and financial sense for the banks who grant them. The fact of the matter is, Mortgage companies and banks are NOT in the real estate business. They are in the LENDING business. The last thing they want is that property back.

Can FHA, Conventional or VA loans receive a short sale?

Yes! I have successfully negotiated short sales for each of these loan types.

Why does my property have negative equity?

Here are a few common reasons:

-Person bought at the height of the market and the market has now declined or paid more than the property was worth.

-The area has become less desirable for any number of reasons, so property values have declined.

-Person purchased the home with little or no money down and wants to sell within a few years of purchase… and the property value has not increased during that time. Therefore, costs associated with selling the property may create a balance due at closing,

-Person refinanced the home (with a high appraisal value) and now has little or no equity.

-Person bought in a brand new subdivision or recently developed area that has not been fully developed or has not appreciated (or has depreciated) in value

-The market is soft because there is too much builder (new home) inventory or too many existing homes on the market (buyer’s market)

What is Negative Equity?

Also known as being "upside down" negative equity is the difference between the value of an asset and the outstanding portion of the loan taken out to pay for the asset, when the latter exceeds the former. For example, if your car is worth $10,000 and you owe $15,000 on it, you would have a negative equity of $5,000. Negative equity can result from a decline in the value of an asset after it is purchased.

Some areas decline in value. In other areas, prices may remain flat so that the properties in that area do not appreciate. If a seller wants to sell within 2-3 years of purchasing their property, they may be in a situation where they have negative equity.

What if I owe what my home is worth?

Even if you owe exactly what your home is worth, you may still need to do a short sale in order to pay for the costs of the sale (Realtor fees, Title Policy and other seller & buyer closing costs).

Why not just let my lender foreclose?

NO! What is the first thing banks do when they foreclose on a property? Hand it over to a real estate agent to get rid of it quick! The foreclosure process is a legal process. It involves attorneys and it costs MONEY. Once they get the property back via foreclosure they must often sell it for MUCH LESS than market value and pay Realtor commissions and all customary closing costs. Doesn’t it make more sense for them to take at or a little below fair market value before foreclosing?

And, even when they do sell it through foreclosure... this does NOT remove your obligation to repay the remaining balance! It is not wiped away!!!

How long does it take?

Short sale approval can take 60 days or longer.

What if my home is already in foreclosure?

Your foreclosure sale will usually be suspended during the short sale process. That's why it's imperative that you contact us right away!!!

Will my lender send me a 1099 on the debt forgiven?

In 2007 the U.S. Congress passed the Mortgage Debt Forgiveness Relief Act and it is in effect

until 2012. As a result of that act, borrowers no longer pay taxes on the debt forgiven on their primary residence. So if the property is your primary residence, then no, you should not receive a 1099 for the debt forgiven or have to pay any taxes on the forgive debt.

For investment property, the lender does have the right to report to the IRS the amount they have ‘forgiven’ in a Short Sale transaction, the amount of the resulting tax will be far less than the debt forgiven. For example, we had one client who did get a 1099 for $30,000 forgiven. This resulted in additional taxes of $1,300 for that year. The resulting tax is far superior to paying the difference of the debt. Also, if the property is in foreclosure, the foreclosure would have a much more devastating affect on you than the amount of the 1099.

For more information go here: http://www.irs.gov/individuals/article/0,,id=179414,00.html

What kind of marketing will you do on my property?

Since last year we have successfully sold 15 short sales.

On our regular listings, we do employ an extensive marketing plan, however we have found that traditional marketing mediums (flyers, virtual tours, open houses, showing feedback surveys, etc) are not effective at generating offers on short sale listings.

What generates success on our short sale listings is over 90% dependent on the property’s PRICE. We typically review the pricing and make adjustments every week or so until an offer is generated.

In addition to pricing, we employ a strong internet marketing presence. We have teamed up with REALTOR.com and ListHub.com to market your property on over 150 web sites.

If there are very few calls or lookers, then we will need to adjust the price until we get an offer. We typically generate an offer within 30 days, unless the property is very unique.

Can I lease out my house while we’re waiting on the short sale?

We don’t recommend that you lease your home while waiting on the short sale to be finalized. Lenders will not be sympathetic to sellers who are collecting rent payments and not making their mortgage payment. Also, homes with tenants are subject to legal rules (tenant rights) and much more difficult to show and to sell.

How will you decide on the list price of my home?

Initially we will set the price based on his extensive market anlaysis. Once we have an offer we will submit that to the bank. Once we convince the bank to agree to do a short sale on your home, they will hire their own independent appraiser who will come out and view your home, and set a valuation, based on its condition.

In order to get the process going quickly, we will need to send you our short sale package and get all of the necessary information we need back from you first, before one of our team members goes out to put up the sign and lockbox.

Who will let me know what I need to do to the home to get it ready for sale?

We won’t be recommending that you do anything to the home that will cost you money. The truth is, since you won’t be netting anything from the sale, the last thing you probably want to do is spend more money on a home you no longer can afford. For that reason, we will be selling your home as-is. Our only suggestion is to clear out as much clutter as you can and keep it clean. Other than that you’re OK. The lender will price your home according to its condition.

I feel so guilty and ashamed for putting myself in this position. How did I allow this to happen to me?

If you learn only one thing from visiting us I hope it’s that you allow yourself to be free of guilt and shame over your circumstances. We are in the midst of the greatest economic downturn in our history as a nation. I don’t believe you are personally responsible for turning our economy upside down nor do I think you are personally responsible for dropping property values 20% to 70%. If you are somehow responsible, please contact us for a different answer to this question.

The only thing you are really guilty of is BAD TIMING. You probably purchased or refinanced your property in 2005, 2006 or 2007. Your circumstances would be quite different if you had purchased or refinanced in 2002 or 2003, wouldn’t they?

If ever there was truth to the notion that there is safety in numbers, you can feel safe in the knowledge that millions of homeowners share your pain and your circumstances. I do not wish to make light of the problem but let’s recognize it for what it truly is. This is “where” you are in life and not “who” you are in life.

Should I stop paying my mortgage in order to complete a short sale? Is it required?

Oversimplified, the short answer is….unfortunately, yes. In reality, this very difficult choice is personal and must only be made after careful consideration of all the benefits and consequences. First I’d like to address the personal and emotional challenges of this issue.

We often feel compelled to continue making mortgage payments even when we can’t afford to continue any longer. Pride, commitment, honor, duty and obligation are all very deeply rooted core beliefs (and rightfully so) that interfere with our ability to make objective choices which might be best for our personal well being and that of our family.

Our sense of duty and obligation is so strong that many of us will borrow from credit cards, draw from savings or retirement accounts (don’t EVER do that) or borrow money from family and friends in order to make the mortgage payment. We don’t realize that digging the hole deeper will not help us get out of our hole. The first rule of recovery when digging a hole is to STOP DIGGING!

When you are deeply upside down in property value (meaning your home is worth less than you owe), you must realize how long it will take for your property value to return to its pre-recession levels. If you have lost more than 25% in value, it’s not likely that your home will return to its prior value in our generation. Think about that. It could take an entire generation for values to restore themselves above the amount that you owe on the property.

That means that you can’t out save this economic downturn. You can’t out live it. You can’t out last it. Every dollar you spend on your mortgage, when significantly upside down, is a dollar that will not be returned. That same dollar will not provide value to you and cannot be spent on your family. If you are upside down in value, you are effectively renting your home.

Do you mind if I repeat that? If you are upside down in value, you are renting your home.

So when choosing whether to continue making mortgage payments you have to first decide what value you receive in return, if any?

As a practical matter, we intellectually rationalize that it’s important to continue paying the mortgage in order to preserve our credit (which is a false belief). Please refer to credit consequences of a short sale for more information.

In addition, it is virtually impossible to get your bank/lien holder to approve a short sale request if you are still current on your payments. Not totally impossible, just virtually impossible. From their perspective, non-payment is a default. Why would they help you to default on their mortgage? They wouldn’t.

Banks/lien holders are very conscious of our private guilt and our need to honorably fulfill our commitments. They would prefer that we listen to our inner conscience and not default even if it’s not in our personal best interest, or that of our family.

If I stop paying my mortgage, should I stop paying my homeowner or condo dues?

No. We recommend that homeowners continue to pay their HOA or condo dues even when in default on their mortgage. This assumes that the homeowner can financially afford the payment and it’s a choice, not a struggle.

Nonpayment affects your neighbors. Homeowner and condo associations run on a strict and limited budget. When they don’t receive payments, it has a direct and immediate impact on their bottom line and trickles down to your neighbors. It can affect property values, benefits and services and quality of life for neighbors. I wouldn’t want a neighbor to do that to me and I wouldn’t want to do it to a neighbor, if possible.

In addition, many associations are now fighting back and seeking personal judgments against the homeowners for non-payment.

If the homeowner can no longer afford the payment, that becomes the most important consideration and they should not pay. A homeowner should not worsen their already tenuous financial position just to make the payment for HOA or condo dues. But, if they have a choice, we ask them to choose to pay the dues.

In our short sale program, we don't put a lot of stock in hardship. Everyone has a hardship. Not long ago, hardship was an important consideration in gaining lender approval for a short sale. While it's still considered a benchmark that must be addressed, it's just a benchmark. In the hands of the right short sale negotiator, it's just one more box to check off to confirm that all requirements have been satisfactorily provided to the lender.

Our position with lien holders is that the homeowner is NOT paying their mortgage and nothing that happens during the negotiations will change that. There is not going to be a miraculous epiphany on behalf of the seller where he asks forgiveness, brings his loan current and pays on time through maturity of the loan. The lien holder can either accept a full price, non-contingent, As-Is offer or they can foreclose. Remember, we can't do more than offer the best contract that the market can offer.

I'm not intending to make the hardship sound insignificant. You can't write a hardship letter saying you don't feel like paying your mortgage anymore. But you are also not a prisoner of your home. If you want to, or need to, move and are upside down by $100K and don't have $100K, you have a hardship.

There is no better hardship than, "I'm moving. I'd love to stay but I can't. I'd love to pay, but I can't. I don't have $100K so I'm asking for you to accept my short sale offer." There doesn’t need to be an explanation for why you are moving (although there can be). A lender can't force you to stay in your home just to pay their mortgage, especially when everyone around you is abandoning their home. An informed lender knows that they'll have little choice but to accept the short sale if the purchase offer is a market price offer.

It is highly unlikely that you will lose your security clearance or employment because of a short sale. I want you to truly understand your unique circumstances so that you can approach your direct supervisor or human resources department for help AND FOR APPROVAL TO COMPLETE A SHORT SALE while stopping your mortgage payments.

You probably have a tendency to believe that your problems are unique to you which probably causes you to feel isolated. I want you to remember that millions of people just like you are dealing with the issue of being unable to continue paying for their home every day.

It’s such a common phenomenon that most HR departments, even at the highest level of government, have a standing policy for dealing with short sales.

There are many factors that were considered to determine your eligibility for obtaining, or retaining, a security clearance or specialized employment. Credit is only one of the factors used. Let’s understand why credit might be a factor for consideration in such matters.

Employers will want to review a credit REPORT, not a credit SCORE. A credit report is a combination of your credit score and your credit history. Your credit history tells a story of how you have used your credit in your lifetime. Have you exercised good judgment and decision making in your personal use and management of credit? You probably have.

A historical review of credit also helps employers determine if you are vulnerable to influence from third party sources (such as bribery and extortion) because of poor financial judgment. Are you vulnerable to bribery or extortion? You might be if you don’t get rid of your upside down mortgage.

Remember that even if your credit score drops, your credit history will remain intact but it will now include a negative event THAT YOU DIDN’T CAUSE.

Most personnel and human resource departments realize the short sales are an everyday part of our life in this economy. They know that you didn’t cause your circumstances and that by getting rid of the mortgage debt that acts like a financial anchor around your neck, you are exercising good financial judgment and decision making (because failure to act would make you vulnerable to third party influence - such as bribery and extortion).

Also, I don’t know if this describes you but most people face the prospect of a short sale BECAUSE THEY DON’T HAVE ANY CHOICE. They are unable to continue paying their mortgage long term. They need to sell but they owe more than the home is worth and don’t have the financial resources to pay the deficiency. Regardless of whether their supervisors deem it permissible or not, they will do a short sale….which will affect their credit score even if they didn’t stop paying their mortgage. But failure to stop paying their mortgage will likely disqualify them from being approved for a short sale. It’s a Catch 22.

If I’m describing you, I recommend that you actually try to apply for a modification. I don’t recommend this very often. Applying for a modification will demonstrate to your employer/supervisor that you did everything that was reasonably possible to avoid a short sale or mortgage default. Of course, you won’t receive a modification that will cure your mortgage burdens but it’s the process of demonstrating that you tried that matters.

Stop and think about your circumstances. Do you really think that if your employer knew about your financial struggles that they would say, “That’s tough. Find a way to work it out”? Of course they wouldn’t. Would you want to continue working with/for them if they did say that?

Please don’t take my word for it. This is such a critical and sensitive issue but you also don’t have to guess, wonder or worry. The answer can easily be determined by simply asking the question.

Approach your supervisor or personnel department (immediately) to share the reality of your circumstances and ask for guidance. You will likely learn that you weren’t the first to ask (and won’t be the last). They will likely assure you that a short sale will not jeopardize your security clearance or continued employment. It’s that simple.

If it turns out that I’m wrong, and the supervisor refuses to consider allowing you to do a short sale, what are you going to do? You can’t keep making your payments. Maybe you can in the short term but you can’t do it forever. If you’re upside down by 30% or more, you have a short sale in your future. I haven’t encountered any employer that would act, or react, so harshly given the unique circumstances.

I have shared this advice with hundreds of homeowners with security clearance, many with the highest possible clearance, and not one has ever come back to me and told me that their request was denied.

However, in order for this approach to work, you must REALLY believe that you didn’t cause the financial turmoil that turned your home value upside down so that you can’t sell your home or afford your mortgage. If you believe that you are somehow personally responsible for dropping property values by 30, 40 or 50%, then you will not effectively convince your employer (or anyone) that you should not be held accountable for exercising poor judgment and decision making. And if you believe that you are responsible for dropping my/our property values, you are advised to seek therapy immediately because you have a denial issue!

Since this is a difficult issue which may be hard to reconcile, here are the critical points you should include when discussing your circumstances with a supervisor or personnel department. It’s presented in letter form just in case you can’t bring yourself to have this discussion in person:

To Whom It May Concern:

Because of an unforeseen hardship (see attached hardship letter) I am unable to continue paying my mortgage under the current terms.

My lender has been unwilling, or unable, to modify the terms to an affordable or manageable level.

Due to a significant decline in home values I owe more money to my mortgage lender(s) than my home is worth.

I am unable to stay in my home under the current mortgage terms and am unable to sell my home for the full value of the mortgage debt.

My only known option is to proceed with a short sale (where my lenders agree to accept less money than they are owed in exchange for releasing their lien on the property).

A short sale will have a temporary negative impact on my credit score. In addition, it is necessary for me to stop paying my mortgage in order to qualify for the short sale approval (which may have an additional short term negative impact on my credit score).

I’m aware that my credit profile is a consideration in approving/maintaining my security clearance.

Please understand that my overall credit history reflects excellent performance, choices, judgment and behavior.

My credit is very important to me, as is my current job/position and my security clearance.

While I accept the credit consequence of a short sale, I also understand that I was not the cause of the economic circumstances creating my hardship or loss in property value.

My credit score will improve quickly but my overall credit history remains the best indicator of my (continued) eligibility for a security clearance.

I ask that you (look favorably on my application for a security clearance or government contract) or (do not revoke my current security clearance or government contract) for all the reasons previously discussed.

I will gladly consider any other alternatives or options that might be available provided they can cure my current mortgage burden and allow me to keep my current employment and security clearance.

Thank you for your time and consideration. I am happy to provide any additional information upon your request and look forward to your favorable response.

to set up an appointment to see if a Short Sale is right for you.