What has been your experience with the bank coming back and demanding full payment despite previous agreement?

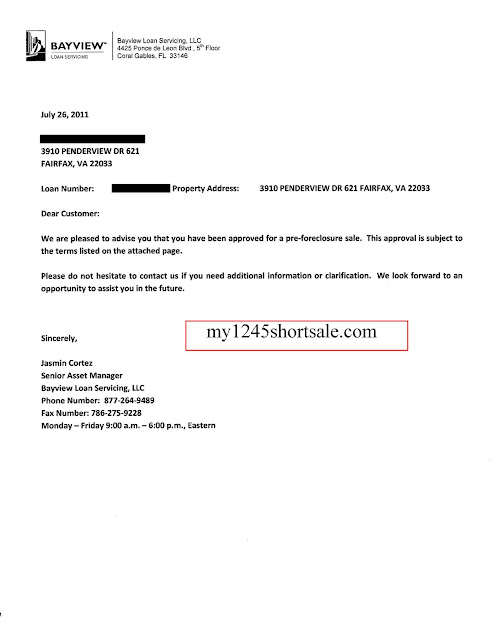

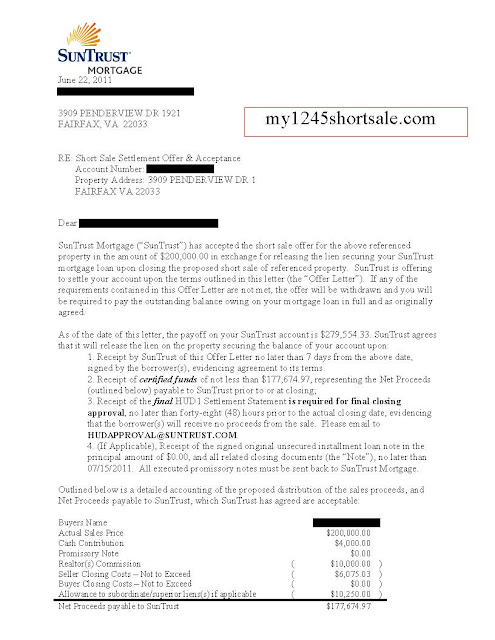

First off, all of our sellers have been forgiven their deficiencies. We negotiate hard to make this happen. Usually a small cash contribution from the seller is required for this. This amount is typically 2-4 months worth of mortgage payments. In the case we can't get a deficiency waived in the future, here is what you should do next.

(Here's the answer as it applies to VA. For states that are non-deficiency states, some of this won't apply.)

For the most part, many lenders are NOT going after the deficiency, although in many states they do have the right to do so in most cases; dependent upon the language of the short sale settlement/lien release letter and local laws. As you probably know, the primary goal of the short sale is to release the lien in order that we may sell the secured asset. If a deficiency judgment is issued on the balance, it's an unsecured debt - just like a credit card debt.

What some banks have been fond of doing these days is selling their ‘non-performing assets' to collection agencies. These are really considered in the industry as ‘uncollectable' debts, and so in most cases they are sold for roughly 2 cents to 10 cents on the dollar. For example, if a 30,000 debt is sold, it probably costs the purchaser $600 to $3,000. Most collection agencies are buying them in bulk at these low rates.

There are many routes you can take to deal with a deficiency judgment. Some options include the following:

Pay the Debt in full. You could choose to completely repay the deficiency over time.

Ignore. If you ignore the debt, it goes away eventually (7 years or so) but can be a nuisance in the meantime - with collector calls, etc.

Settle. Since you know the debt was purchased for such a small amount, settlement is always an option. I recommend you conduct all such settlement in writing (via email, fax or snail mail - back and forth). This will be a personal decision, weighted by many factors. There is doctrine that supports that settling debts actually can lower your credit score. Here are some article reference that may help: http://articles.moneycentral.msn.com/Banking/YourCreditRating/WhenPayingBillsCanHurtYourCredit.aspx

File Bankruptcy. Many homeowners exit the short sale transaction with a huge amount of ‘other' debt. For some, there doesn't seem to be another alternative but bankruptcy. If they do not wish to ignore the debt, and don't choose to settle, bankruptcy sometimes comes into play. Still, they have avoided the stigma and damage of a foreclosure and the bankruptcy will typically wipe off out all remaining unsecured debt.

First off, all of our sellers have been forgiven their deficiencies. We negotiate hard to make this happen. Usually a small cash contribution from the seller is required for this. This amount is typically 2-4 months worth of mortgage payments. In the case we can't get a deficiency waived in the future, here is what you should do next.

(Here's the answer as it applies to VA. For states that are non-deficiency states, some of this won't apply.)

For the most part, many lenders are NOT going after the deficiency, although in many states they do have the right to do so in most cases; dependent upon the language of the short sale settlement/lien release letter and local laws. As you probably know, the primary goal of the short sale is to release the lien in order that we may sell the secured asset. If a deficiency judgment is issued on the balance, it's an unsecured debt - just like a credit card debt.

What some banks have been fond of doing these days is selling their ‘non-performing assets' to collection agencies. These are really considered in the industry as ‘uncollectable' debts, and so in most cases they are sold for roughly 2 cents to 10 cents on the dollar. For example, if a 30,000 debt is sold, it probably costs the purchaser $600 to $3,000. Most collection agencies are buying them in bulk at these low rates.

There are many routes you can take to deal with a deficiency judgment. Some options include the following:

Pay the Debt in full. You could choose to completely repay the deficiency over time.

Ignore. If you ignore the debt, it goes away eventually (7 years or so) but can be a nuisance in the meantime - with collector calls, etc.

Settle. Since you know the debt was purchased for such a small amount, settlement is always an option. I recommend you conduct all such settlement in writing (via email, fax or snail mail - back and forth). This will be a personal decision, weighted by many factors. There is doctrine that supports that settling debts actually can lower your credit score. Here are some article reference that may help: http://articles.moneycentral.msn.com/Banking/YourCreditRating/WhenPayingBillsCanHurtYourCredit.aspx

File Bankruptcy. Many homeowners exit the short sale transaction with a huge amount of ‘other' debt. For some, there doesn't seem to be another alternative but bankruptcy. If they do not wish to ignore the debt, and don't choose to settle, bankruptcy sometimes comes into play. Still, they have avoided the stigma and damage of a foreclosure and the bankruptcy will typically wipe off out all remaining unsecured debt.